Myloan Elect

LATEST NEWS

Important update: Elect products will be discontinued from 30 September 2025

After careful consideration, the NAB Group has made the decision to close the Advantedge business, which fund the MyLoan Elect product.

In light of this decision, we wanted to ensure you had all the relevant information and give you a clear picture of what you and any existing customers can expect.

Key Information

- From 30 September 2025, Advantedge/Myloan Elect will cease accepting new home loan applications.

- Existing customers can continue to submit variations (including credit critical variations) after 30 September 2025.

- Commission payments will continue to be paid on existing loans

- The Customer Care team remains open for business on 1300 300 989 or customercare@advantedge.com.au. Our specialised credit assessment and operations teams will also continue to service requests.

- In 2026, all Advantedge home loans will transition to a NAB branded home loans. We will update you on specific dates and timing as we progress through the planned transition.

Supporting your customers

FAQs have been prepared for customers which are available here: Customer FAQs.

Furthermore, letters will be sent to existing customers advising them of the changes. A copy of this letter is available via this link.

We recommend contacting those customers who may be impacted as they may have a few questions about the development.

If you have any questions, please reach out to your Elect BDM!

Check out the latest updates from MyLoan Elect below, including:

- Please finalise any IDyou requests by 29 August and start using InfoTrackID: We will no longer accept any VOI completed through IDyou after Friday 29 August 2025 and you must instead use InfoTrackID.

- Updates to the postcode look-up tool: From 3 September 2025, the Advantedge postcode look-up tool and automated credit decision systems will be updated.

Further Support

If you have any questions, please speak to your MyLoan Elect Business Development Manager.

Please finalise any IDyou requests by 29 August and transition to InfoTrackID

In June, we announced that Advantedge will transition from IDyou to InfoTrackID for all new digital customer identity verification services (VOI and KYC).

To support you with this transition, and help minimise disruption to your business, we’ve continued to accept VOI completed through IDyou for the past two months as an exception.

IDyou will no longer be accepted from 29 August

We will no longer accept any VOI completed through IDyou after Friday 29 August 2025 and you must instead use one of the following methods:

- InfoTrackID ‘In person’ Report

- InfoTrackID ‘Remote (video call)’ Report.

- In-person verification of identity

- Australia Post

Finalising your ‘in-progress’ IDyou requests

To prevent delays and rework, please finalise and submit any IDyou VOI requests you currently have in-progress by COB Friday 29 August.

To complete these IDyou requests, please follow these simple steps:

- Submit the VOI and generate the VOI Report as normal.

- When prompted to select ‘Prepare VOI Report for your chosen lender’, select ‘Other’ and type ‘Advantedge’.

Advantedge will accept these provided you follow the above process and the ‘Date completed’ on the report is shown to be on or before Friday 29 August.

IDyou submitted after 29 August will receive a MIR

While IDyou will continue to allow you to generate the report by manually typing ‘Advantedge’ as the ‘chosen lender’, please be aware that this workaround will no longer be accepted by Advantedge after 29 August. You’ll instead receive a Missing Information Request (MIR) on the application and need to complete the ID verification through one of the three accepted methods mentioned above.

Handy tips for logging into InfoTrackID

- Log out of IDyou on all of your devices before accessing InfoTrackID.

- Use the new InfoTrackID username provided in your welcome email. The InfoTrackID username is different from your email address and previous IDyou login credentials.

- If you haven’t received a welcome email, contact helpdesk@infotrack.com.au and ask them to manually create an InfoTrackID account for you.

Further support

We’ve developed a comprehensive set of ‘InfoTrackID FAQs’ which will help you get set up with InfoTrack and begin using the system. You can access it on the advantedge.com.au website via the following pathway: Advantedge.com.au > Mortgage brokers > Digital verification of identity.

If you need any technical support (e.g. login or video call issues), you can contact InfoTrack’s support team:

- Email: HelpDesk@infotrack.com.au

- Phone: 1800 878 998 (Option 1)

- Hours: 8:00am – 5:00pm, Monday to Friday (AEST)

- InfoTrack Dashboard: https://search.infotrack.com.au/webvoiv2

Updates to the postcode look-up tool

Advantedge is committed to protecting our customers and lending responsibly. As part of this commitment, Advantedge regularly reviews restricted postcodes and makes these available in our postcode look-up tool.

From 3 September 2025, the postcode look-up tool and automated credit decision systems will be updated to reflect changes from our most recent review.

Existing policy and treatment of securities in restricted postcodes remain unchanged.

What you need to do

- You should continue to check the postcode tool for every new home loan application as lending requirements may change.

- Our credit assessors may reach out to you to provide appropriate mitigants when they are assessing an application.

- Refer to your Aggregator CRM to access the updated Postcode Look-up Tool from 3 September.

- Refer to the pipeline treatment to understand any needs for in-flight applications and scenarios that may need further overview.

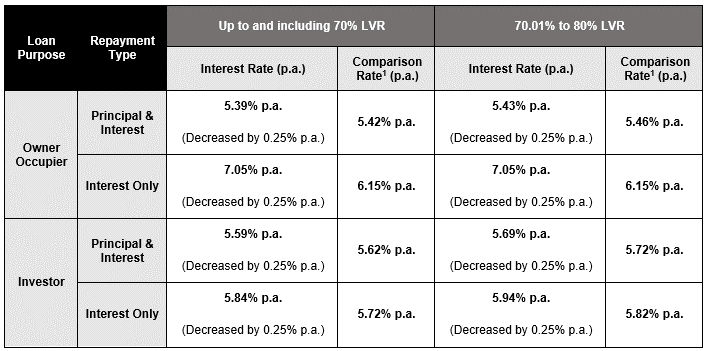

In line with the August 2025 RBA announcement, effective Tuesday 9 September 2025, MyLoan Elect is decreasing variable interest rates for both new and existing variable rate home loans

Effective Tuesday 9 September 2025, variable rates are decreasing for new and existing lending by 0.25% p.a.

For example, interest rates for new lending with ≤80% LVR will be as follows:

For more important information on comparison rates, please refer to ‘Important Information’ section below.

Pipeline applications – timing

- The effective date of this change will be no earlier than Tuesday 9 September 2025 for in-flight applications, but will vary depending on the loan settlement date as follows:

o Loans settled before 5pm Monday 18 August 2025 will have variable rates decreased by 0.25% p.a. on Tuesday 9 September 2025

o Loans settled after 5pm Monday 18 August 2025 will retain their current contracted variable rates until the month following settlement, when they will be decreased by 0.25% p.a. The adjustment will not be retrospective

- All variable rate loans formally approved and instructed on or after Tuesday 9 September 2025 will receive the rates on the updated rate card

Pipeline applications – reassessment

- AIP – to purchase a property

This can be in place for 90 days providing there is no credit critical change.

- Conditional Approval to refinance / cash out / consolidation etc

These loan applications must service at the rate of the date of the final loan assessment.

A full set of rates will be made available on our systems from Tuesday 9 September 2025.

Reminder: On 11 June 2025, NAB announced that MyLoan Elect will stop accepting new applications from 30 September 2025 and all existing home loans will migrate to a NAB branded home loan in 2026. To ensure a smooth transition for you and your customers, please take note of the following cut-off dates:

- New applications and variation requests to add a new borrower must be submitted prior to 5.00pm (AEST) on 30 September 2025.

- New applications must reach unconditional approval prior to 5:00pm (AEDT) on 31 October 2025 and settle on or prior to Monday 2 February 2026.

For more information about this transition, please refer to the Migration of Advantedge home loans to NAB page on the Advantedge website.

If you have any questions, please contact your Business Development Manager.

Enhancements to how we assess HECS/HELP repayments

From Thursday 31 July, MyLoan Elect will allow for HECS/HELP repayment amounts to be excluded from servicing assessments (when needed) with evidence from the ATO that the HECS/HELP limit is $20K or below.

This applies to new and in-progress applications submitted from 31 July 2025.

Important: You still need to capture the full HECS/HELP liability and repayments when submitting the application.

What you need to do when submitting an application for customers with a HECS/HELP debt of $20,000 or less:

If your application is going to fail serviceability requirements, but would pass if the HECS/HELP repayments were removed, then please follow these steps:

- Include the full HECS/HELP liability and repayment as normal when lodging the application. Our credit assessment team will apply a servicing override to exclude these repayments during the assessment.

- Attach a screenshot or PDF of the customer’s outstanding balance from their ATO portal that confirms the customer debt limit is $20,000 or under.

- Add to your broker notes that servicing is based on the HECS/HELP debt being removed.

Note: This process is only required when an application needs the HECS/HELP debt excluded to meet serviceability requirements. For all other applications with HECS/HELP debt, continue with your standard lodgement process – there’s no need to apply these additional steps.

Why this matters

This change reflects MyLoan Elect’s commitment to supporting customers in achieving their homeownership goals. By improving serviceability assessments for those with low HECS/HELP debt, we’re helping more Australians turn their property dreams into reality.

If you have any questions, please speak to your MyLoan Elect Business Development Manager or the Advantedge Business Associate team.

One-Year Tax Return for 80% LVR or Under

We only require a one-year tax return, accompanied by confirmation that it’s been lodged to the ATO, to verify self-employed income for MyLoan Elect applications with an LVR 80% or under.

For home lending applications with an LVR 80% or under:

- You can submit a one-year tax return, accompanied by confirmation that it’s been lodged to the ATO, to verify self-employed income for home lending applications with an LVR 80% or under.

- Tax returns will be the only document we accept to verify self-employed income for these applications..

For home lending applications with LVR over 80%:

- There will be no change to the requirement to provide two years of financial information to verify self-employed income for home lending applications with an LVR over 80%.

- However, you’ll now be able to provide either two years’ tax returns or two years’ financial statements (profit & loss).

For home lending where financial statements are used to verify income:

If you provide two years’ financial statements and want these to be assessed based on the most recent year, this option is still available when you provide commentary outlining why recent performance is a more appropriate indicator of future performance – as you do today.

Applications that are ineligible for the one-year tax return option:

Where your customer’s tax return is yet to be lodged or only financial statements (profit & loss) are provided, the one-year tax return cannot be used.

For applications that are higher than an 80% LVR follow the existing process.

Some important information to help you begin using InfoTrackID

Earlier this week, we transitioned from IDyou to InfoTrackID for all new digital customer identity verification services (VOI and KYC). Here’s some important information to help you begin using InfoTrackID.

If you were an existing IDyou user, your account should have been automatically provisioned for InfoTrackID, and you should have received a welcome email with your unique login details. This email will come from the email domain ‘@infotrack.com.au’.

Note: When using InfoTrackID, please give your customers a heads up that they will receive an email addressed from ‘National Australia Bank’, which will contain the link for them to access InfoTrackID. Additionally, we encourage you to utilise the optional ‘Additional Instructions for your client’ section to include free-text notes. These notes will accompany the customer email and can provide valuable guidance.

If you were an existing IDyou user and you haven’t received your access email yet

- Check your spam/junk folder first.

- If still not found, email brokercreation@infotrack.com.au and request a manual creation of an InfoTrackID account.

- You’ll receive your unique login credentials via email by the next morning.

New feature: ‘Matter Reference’ field

When initiating a new VOI request, you’ll notice a new ‘Matter Reference’ field. This is a valuable new feature that allows you to:

- Add a unique identifier such as:

- Application ID

- Customer name

- Internal reference number

- Loan reference

- Easily locate and identify specific VOI requests in your dashboard.

- Improve tracking of customer applications through your workflow.

This field is optional but highly recommended for you to better manage your cases.

Current IDyou requests

Remember, you have until Monday 16 June to complete any VOI requests currently in progress through the old IDyou system.

For any of these in-progress VOI requests in IDyou, you can still submit the VOI and generate the VOI Report. When prompted to select ‘Prepare VOI Report for your chosen lender’, you’ll need to select ‘Other’ and type ‘Advantedge’.

Further Support

All resources on Advantedge.com.au have been updated to reflect InfoTrackID instead of IDyou. For more information on using InfoTrackID, refer to the user guide or FAQ document via the following pathway: Advantedge.com.au > Mortgage brokers > Digital verification of identity.

If you have any questions during this transition, InfoTrack’s support team is available and prioritising MyLoan Elect enquiries:

- Email: HelpDesk@infotrack.com.au

- Phone: 1800 878 998 (Option 1)

- Hours: 8:00am – 5:00pm, Monday to Friday (AEST)

- InfoTrack Dashboard: https://search.infotrack.com.au/webvoiv2

If you have any questions, please speak to your MyLoan Elect Business Development Manager.

Effective Tuesday 17 June 2025, variable rates are decreasing for new and existing lending by 0.25% p.a.

For example, interest rates for new lending with ≤80% LVR will be as follows:

For more important information on comparison rates, please refer to the ‘Important Information’ section below.

How we’re telling your customers

Customers with an existing variable rate home loan will receive a letter advising them of changes to their interest rate and repayments.

Pipeline applications – timing

The effective date of this change will be no earlier than Tuesday 17 June 2025 for in-flight applications, but will vary depending on the loan settlement date as follows:

- Loans settled before 5pm Tuesday 27 May 2025 will have variable rates decreased by 0.25% p.a. on Tuesday 17 June 2025

- Loans settled after 5pm Tuesday 27 May 2025 will receive their current contracted variable rates

- All variable rate loans formally approved and instructed on or after Tuesday 17 June 2025 will receive the rates on the updated rate card

Pipeline applications – reassessment

- AIP – to purchase a property

This can be in place for 90 days providing there is no credit critical change.

- Conditional Approval to refinance / cash out / consolidation etc

These loan applications must service at the rate of the date of the final loan assessment.

A full set of rates will be made available on our systems from Tuesday 17 June 2025.

InfoTrackID is our new provider for digital customer identity verifications

Starting from Monday 2 June, we will transition from using IDyou to InfoTrackID where digital customer identity verification (VOI and KYC) is completed. This change aims to enhance the security and efficiency of the verification process for both you and customers.

You will be able to verify a customer’s identity using one of the following methods:

- In-person verification of identity (unchanged from current process).

- InfoTrackID ‘In Person’ Report.

- InfoTrackID ‘Remote (Video Call)’ Report.

- Australia Post (no change).

Why we’re making this change

InfoTrackID includes three new in-built fraud mitigation measures:

- Facial biometrics is utilised in the video call to ensure a real person is performing InfoTrackID, preventing impersonation attempts.

- Optical Character Recognition (OCR) which pre-populates data fields.

- Document Verification System (DVS) to confirm authenticity of the ID by checking against the original record.

As a broker, you’ll also enjoy a smoother experience with new alerts when there’s an expired driver license or Australian passport over two years old. These improvements minimise errors and ensures we remain compliant – making your verification process faster, safer and simpler.

Note: Please give your customers a heads up that they will receive an email addressed from ‘National Australia Bank’, which will contain the link for them to access InfoTrackID.

Further Support

- From 2 June, any references to IDyou on Advantedge.com.au will be updated to ‘InfoTrackID’.

- The Advantedge Lending Guidelines Manual will replace references to IDyou with ‘InfoTrackID’ by mid-June (pages 5 & 29).

- The Advantedge Supporting Document Checklist will update IDyou references to ‘lender’s preferred ID verification application’ in July (page 1).

If you have any questions, you can contact the InfoTrack support team email address (HelpDesk@infotrack.com.au).

Alternatively, you can call their help desk on 1800 878 998 (IVR Option 1). They’re available from 8:00am – 5:00pm Monday to Friday (AEST) excluding public holidays.

Upcoming changes to expense classifications and HEM values

From Friday 23 May, our systems are being updated to now include Owner Occupied Body Corporate / Strata fees within Household Expenditure Measure (HEM) as a basic expense, rather than as a separate additional expense.

Please continue to capture the fees for primary residences to support the correct serviceability outcomes for your customers by following the below:

- Body Corp / Strata Fees: Decision tools will be updated so Owner Occupier Body Corporate / Strata Fees will be treated as a General Living Expense (GLEE). This is currently treated as an Additional Living Expense (HEM-add on).

Other expenses

Our systems (including decision tools) are being updated so ‘Other’ expenses will be treated as Additional Living Expenses (HEM add-on) – this is currently treated as a General Living Expense (GLEE).

What you need to do

- Please ensure any Body Corporate/Strata Fees for the owner-occupier property continue to be captured in the correct field, which is Body Corporate/Strata Fees.

- All Secondary Residence / Non-Principal place of residence (e.g. holiday homes) should be captured in ‘Other’.

- Please refer to the ‘pipeline applications’ in the section below.

Updated HEM values and serviceability calculator

We’re also updating the Household Expenditure Measure (HEM) values used in our home loan serviceability assessments, in line with our regular review process and to meet APRA requirements.

New serviceability calculator

The latest version of the Advantedge Serviceability Calculator (V53) will be available on your aggregator systems from Friday 23 May.

Pipeline applications

- For any new home lending submitted after 12:00am (AEST) on Friday 23 May 2025, please use v53 of the Serviceability Calculator.

- Click here for full details on how to treat pipeline applications.

A new ‘Floor Size’ field in PropertyHub

On Tuesday 13 May we added a new ‘Floor Size’ field in PropertyHub for valuation requests where the property is any Apartment property type.

What you need to do

Brokers will now need to enter the ‘Floor Size’ for these valuations. This will help prevent unnecessary delays by ensuring the correct ‘Service Type’ is automatically applied when you order the valuation.

There is no change to the way valuations are ordered in PropertyHub.